Monitoring your credit report and credit card statements very carefully is critical during this tough time, as credit complaints have spiked during the pandemic.

According to a new study just released by a consumer advocacy organization called U.S. Pirg, the number one complaint is credit reporting and credit repair services.

Complaints to the Consumer Financial Protection Bureau have spiked 50-percent from March to June.

The big ones have been credit reporting mistakes or problems with debt collection, credit card company issues, or mortgage issues.

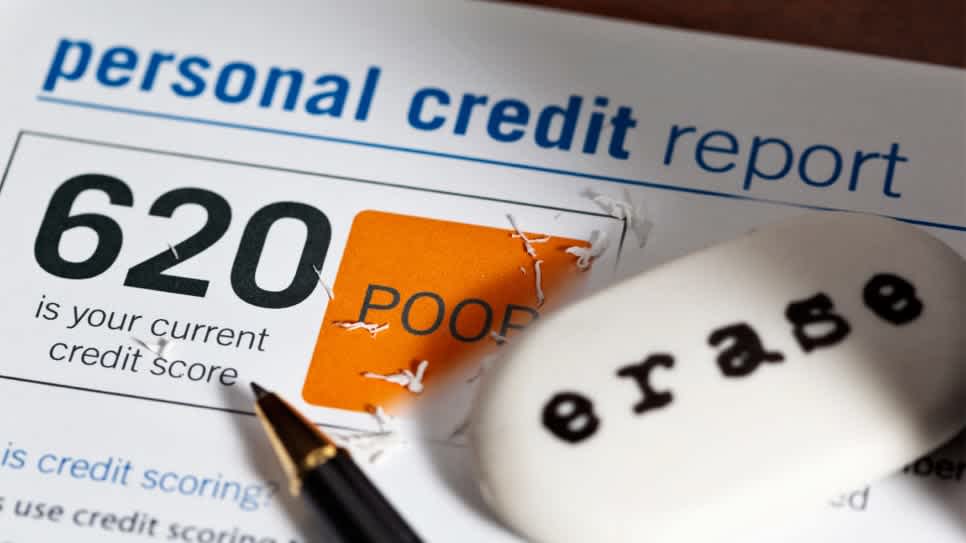

How To Monitor Your Score?

If you’re eager to monitor your credit score — you can do so quickly with Experian Boost™.

Experian Boost™, may be the best product to boost your FICO Score® and manage your overall credit profile. All you have to do is sign up and verify that you have been paying your bills on time (cell phone bill, cable bill, other utilities.), and you could get an INSTANT credit score boost.

Plus, it’s FREE! Some Experian Boost™ customers have seen a jump as high at 47 points in 15 minutes. Results will vary, see Experian’s ™ website for full details.