Why Your FICO Score Is Fluctuating

Christina Rodgers

Wondering why your FICO score is a few points higher or lower than it was last month? Several factors can cause your score to shift, such as your credit usage and on-time payments. Read below to find out exactly what this type of credit score is, as well as what can cause changes in scores over time, from 45 days to six months.

What is a FICO score?

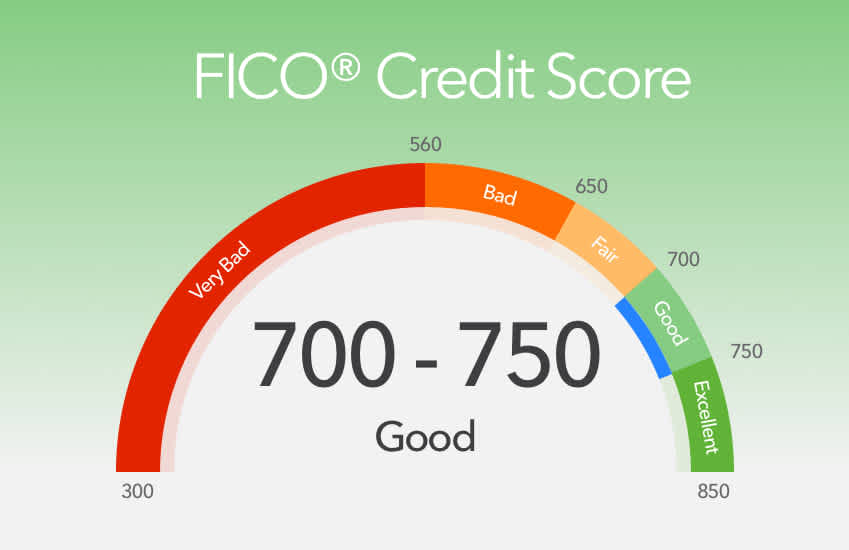

In short, this score lets lenders (such as banks and credit card companies) know-how “safe” you are to lend money to. In other words, it helps them to determine how likely you are to pay the money back which you owe.

A high score is a prerequisite for applying to many credit cards and obtaining many different types of loans. Your score will change continually, mainly if you use credit. This is because you are continuously making purchases and payments on your credit cards and making payments on your loans.

This score differs from other types of credit scores because this type of score is the industry standard when it comes to credit reporting. Most lenders will look first for this score rather than looking for any other type of credit score.

Why does your score change from month to month?

There are several reasons why your score fluctuates up and down from one month to the next, including…

You acquired more debt or paid off debt

When you make a big purchase on a credit card, or get approved for a new loan, the total amount of your debt will increase.

For example, if you have $1,000 in debt across all of your credit cards, and then make a $5,000 purchase on one of your cards, your total debt amount just went up by $5,000. This will cause your score to drop the following month.

Then, it follows that if you pay off a large amount of debt from one month to the next, your score will increase. If you gradually pay off debt over the course of several months, without adding any new debt, you will see a credit score boost.

You made a late payment

Late credit card or loan payments leave a mark on your score. If you’ve seen your credit score suddenly drop from one month to the next, check all of your accounts to make sure you’re not late on any payments. If you are, pay them as soon as possible– the later you are on these payments, the more your score will dip.

Your last late payment was some time ago

On the other hand, you can see a credit score boost if you’ve gone quite a while without making any late payments. Negative marks (such as late payments and bankruptcy) age as time goes on. This means that the longer you go without acquiring any negative marks, the more your score will rise. It follows that you should always make sure that you pay your credit card bills on time!

The average age of your credit accounts dropped

All of your credit accounts– including [credit cards and loans]– have what’s called an “age.” This is exactly what it sounds like: if you opened a credit card account or applied for a loan two years ago, and you have not closed that account yet, that account is two years old.

Credit scorers look at your “average age” of your credit accounts to determine your score. That means they add the age of all of your credit accounts together, then divide that number by the total number of credit accounts you have.

A high average age makes for a better score than a low average age. How do you achieve a high average age? Make sure you’re not opening new credit accounts too often, as new accounts will lower your average age. In addition, make sure not to close your oldest credit accounts– these older accounts raise your average age more and more the longer you keep them open.

FICO changed its score formula

This point actually has very little to do with you and what you do with your credit accounts. It’s still worth noting, though.

FICO uses a unique set of formulas to determine your score every month, but their formula is not set in stone. Their formulas are continually improving, striving to give both lenders and consumers the best possible information. This means that, from time to time, they change their scoring formula.

If the formula changes, you may see your score fluctuate. It’s difficult to know precisely when this is happening. Still, you may take comfort in noting that if your score seems to fluctuate by a few points without much of a reason for doing so, it may not be your fault– there’s a possibility that the formula changed that month.

The bottom line here is that the more responsible you are with your credit, the more you will see a credit score boost in the long haul. That means that it’s okay to make big purchases on your credit cards, but only if you’re able to pay them off. Also, always make your payments on time, try not to open too many new accounts, and do your best not to close your oldest credit account. If you do your best to follow these guidelines, you’ll find that you get closer and closer to having the fantastic score you’re striving for!