With Federal Reserve Chairman Jerome Powell continuing to raise interest rates, many are worried that their ability to obtain a loan may be out of reach. However, there are currently billions in unclaimed funds that are ready that are just sitting in bank vaults. Interest rates may continue to increase.

Don’t let these unclaimed funds collect dust, put them to good use. Remember checking rates from these companies will not affect your credit score:

Best Loan Option For Any Type Of Credit

Founded in 1999, AmOne has grown to become one of the nation’s largest financial assistance companies for people with fair to bad credit. AmOne connects you with the best offers for personal loans with APR as low as 2.49%.

Whether you are looking for debt consolidation or trying to start a business, AmOne can find you the best deals to get the cash you need.

AmOne has helped over 13 million people find the loans that are right for them.

This Company Offers Loans To Boost Your Savings

SeedFi’s Borrow & Grow Program gives you quick access to the money you need upfront. It gives you quick access to funding (if approved, you can get cash in as little as 24 hrs) and holds the rest in an interest-bearing savings account. SeedFi knows that having savings can help you avoid the need for an emergency loan in the future. Seedfi's rates are closer to what you’d find with a typical personal loan compared to a high-interest installment loan— and there are no hidden fees.

Payments are due twice a month, but they’re synced up with your pay schedule to help you avoid a late fee. Whether your car’s broken down or you’ve made an unexpected visit to the doctor, Seedfi’s “Borrow & Grow” program can help you weather any financial storm.

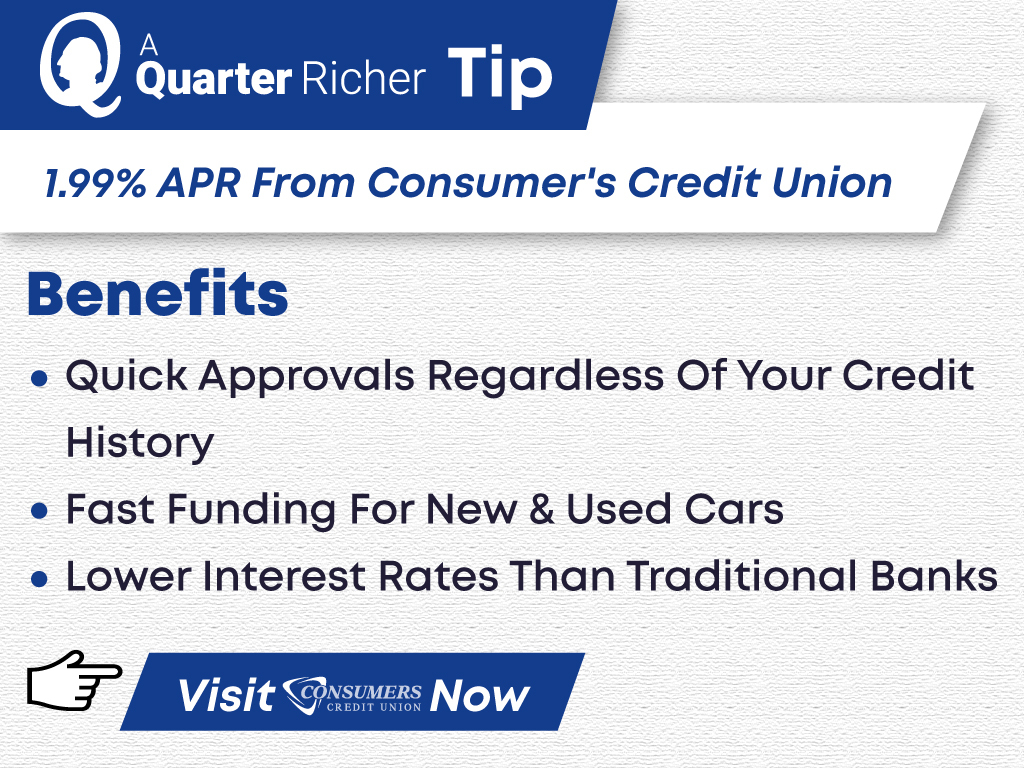

The Best Auto Loans For Any Type Of Credit

Credit unions were founded on the philosophy of people helping people. Consumers Credit Union (CCU) has been serving customers for nearly 100 years. Unlike other credit unions, it’s unique that anyone can join, regardless of where you live or work. CCU has over 1,800 Service Center branches nationwide.

CCU offers some of the most competitive auto loan rates in the nation even for people with bad credit. Credit unions, like CCU, are more forgiving with their lending requirements than banks and other lenders. CCU even allows some borrowers to finance the full purchase amount, with no down payment. Plus, you will get 24hr mechanical/emergency repair coverage.

Expert Tip: If you open a “Membership Share/Savings Account” with just a $5.00 deposit, CCU may provide you with up to 0.5% rate reduction on your auto loan.

Great Fast Cash Loan App

Possible Finance offers same-day loans up to $500. Possible Finance is an excellent alternative to payday loans for people who need cash fast!

Most payday loans have to be repaid within ten days. But because Possible Finance gives you an eight-week payment plan, you’ll have as much as four times the flexibility in repaying your loan compared with traditional payday lenders.

Possible Finance also does not perform a hard credit inquiry during the application process, so you don’t have to worry about this loan hurting your credit score. If you earn more than $750 a month and have some cash in your bank account, you should get the loan you need!

Largest Search Engine For Loans

Fiona is the fastest, easiest, most comprehensive way to search loans and savings accounts from the top providers. By filling out a simple form, Fiona checks if you are pre-approved and gets the best offers from the top providers for you in seconds so that you can get instantly matched with the right personalized recommendation all in one place.

You can borrow as little as $1,000 and as much as $100,000, with loan terms of up to 7 years. The interest rate you’ll pay will depend on your creditworthiness. It will take you less than 60 seconds to apply. Credit card debt can get out of hand fast, but you don’t have to continue paying those outrageous interest rates.

Don’t miss out, applying for a loan to pay off bills or restructure debt may be the smartest thing you do this year.